The 2017-2019 MTEF indicate that the Medium Term Plan for the Nigerian economy is being steered in the wrong direction, though the advantage of the MTEF is that it provides forewarning which if heeded could lead to effective economic corrections.

On Tuesday, November 1, 2016, Nigeria’s President Muhammadu Buhari forwarded the country’s 2017–2019 Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF & FSP) to the Nigerian Senate for discussions and subsequent approval.

The Senate dismissed the MTEF & FSP two days later, describing the document as “empty” and not worth considering. On the same day, the Senate also denounced the presidential aides in charge, describing them as “incompetent,” and accusing them of failing to present a comprehensive proposal on the president’s bid to borrow US$30 billion.

While it is imperative for the Executive arm of government and the National Assembly to work together for the progress and development of the country, it is even more crucial for them to do so especially on economic matters.

The main functions of the Nigerian National Assembly include:

• To make and amend the laws of the country;

• To exercise power and control over public funds (Power of the Purse);

• OPversight of the institutions of the government of the Federation.

• To exercise power and control over public funds (Power of the Purse);

• OPversight of the institutions of the government of the Federation.

The Power of the Purse resides with the National Assembly as explicitly stated by the Constitution of the Federal Republic of Nigeria 1999, Chapter 5, Section 80-89 (Powers and Control over Public Funds); consequently, the Executive and the National Assembly are required to work together to see Nigeria through her current economic challenges.

Explaining the MTEF & FSP

According to the World Bank’s Public Expenditure Management Handbook (1998), the MTEF & FSP is a three-year expenditure plan. Its objective is to set out medium-term expenditure priorities and budget constraints against which development and budgetary plans can be developed and refined. The MTEF is applied towards achieving greater macroeconomic balance, improving resource allocation and enhancing more efficient use of public money.

The MTEF also contains outcome criteria for the purpose of performance monitoring; and along with the FSP, it provides the basis for annual budget planning, as well as the estimate of current and medium-term costs of existing policy. It serves as a useful indicator for fiscal targets, revenue and expenditure estimates for the three years beyond the current (budgeted) fiscal year, which could be effectively applied for matching costs with available resources.

In summary, the purpose of the MTEF is to provide a mechanism for fiscal discipline and reduce deficit spending with the outcome of enabling the efficient use of public monies.

In consideration of the points above, the MTEF & FSP could provide useful insights into Nigeria’s economic prospects. Unfortunately, a review of the 2017-2019 MTEF raises several red flags.

“Recurrent Expenditure”

The Nigerian Federal Government proposes N6.87 trillion for the 2017 budget, with 71.8 percent of the budget committed to recurrent expenditure; made up of salaries, debt servicing, and overhead costs.

Mathematically speaking, 28 percent capital expenditure is a remarkable improvement on previous budgets in percentage terms, till you look at the substantive details.

The recurrent expenditure portion of the 2017 budget, i.e. 71.8 percent of the budget, translates to N4.93 trillion; for scale the total 2012-2016 budget figures are:

2012 – N4.131 trillionn

2013 – N4.56 trillion

2014 – N4.123 trillion

2015 – N4.767 trillion

2016 – N6.06 trillion*

2013 – N4.56 trillion

2014 – N4.123 trillion

2015 – N4.767 trillion

2016 – N6.06 trillion*

The proposed recurrent expenditure for the 2017 budget is more than the entire individual annual budgets from 2012-2015, a period of boom, with very high crude oil prices and attendant higher public revenues. The case with the 2016 budget is also similar.

Between the years 2012 and 2015, the largest recurrent item on the budget was the expenditure for ‘Petroleum Products Consumption Subsidy’; this item has currently been done away with, as indicated by the Federal Government.

The implication of the numbers above is that in a period of economic recession, and increasing hardship for the Nigerian people, the FG’s recurrent expenditure has increased by a significant margin.

Revenue Assumptions

Several of the revenue assumptions in the MTEF are flawed; the projection for national income from Company Income Tax (CIT) for 2017 is N902 billion compared with actual collected revenue from CIT of N162 billion between January and June 2016.

Q1 and Q2 2016 were periods of very slow growth succeeded by a recessing economy in Q3 2016. CIT for 2017 would be negatively impacted by massive business losses from 2016 operations; it is thus untenable to expect an increase in CIT by close to three times 2016 numbers within a year.

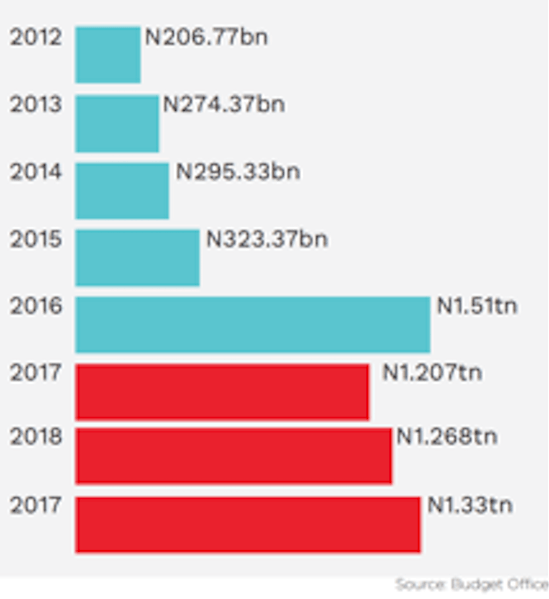

The FG projects N1.2 trillion from Independent Revenue Sources for 2017, the projected numbers for 2018 and 2019 are N1.268 trillion and N1.33 trillion respectively, compared to the numbers from 2012 to 2015:

2012 – N206.77 billion

2013 – 274.37 billion

2014 – 295.33 billion

2015 – N323.37 billion

2013 – 274.37 billion

2014 – 295.33 billion

2015 – N323.37 billion

Nigerian FG’s Independent Revenue (Non-Oil): 2012 to 2015 are actual. 2016 to 2019 numbers are proposed/projected. Credit: budgiT

In some cases, the projections for the years after 2015 are five times more than the highest figures before 2015.

The FG projects an increase of 91 percent in its share of Oil Revenue in 2017 at an exchange rate of N290/$1 and crude oil prices above $42.5 per barrel. This estimate is very unrealistic.

The projected official exchange rate of N290/$1, when market rates for the US$1 is at N465, is also not sustainable, considering Nigeria’s declining revenue in US$ as a consequence of lower oil prices, unstable Crude Oil Production, and declining economic activity.

Expenditure

The strategy of the FG indicates that it plans to increase expenditure in 2017 over 2016 by N806 billion; and even more worrisome is the FG’s plans to increase spending on recurrent expenditure. The Recurrent Expenditure from 2012 to 2015, along with the projected recurrent expenditure from 2016 to 2019 are reproduced below:

2012 – N3.339 trillion

2013 – N3.60 trillion

2014 – N3.54 trillion

2015 – N4.17 trillion

2016 – N4.48 trillion

2017 – N5.1 trillion

2018 – N5.05 trillion

2019 – N5.3 trillion

2013 – N3.60 trillion

2014 – N3.54 trillion

2015 – N4.17 trillion

2016 – N4.48 trillion

2017 – N5.1 trillion

2018 – N5.05 trillion

2019 – N5.3 trillion

Nigerian FG’s Recurrent Expenditure. Credit – budgiT

What the data shows is a massive upsurge in the Nigerian Federal Government’s recurrent expenditure.

To properly address Nigeria’s current economic challenge, the country would have to come to terms with the reality of its dire economic circumstance, and necessary actions should include cutting government waste, reducing recurrent expenditure, downsizing the budget deficit etc., unfortunately the country is headed in the opposite direction.

Though the Presidency had earlier implemented policies in an attempt to reduce government waste, e.g., reducing Petroleum Products Consumption Subsidy and Foreign Exchange Devaluation, old habits die hard, and actions taken so far have not been clinical and total.

The 2017-2019 MTEF indicate that the Medium Term Plan for the Nigerian economy is being steered in the wrong direction, though the advantage of the MTEF is that it provides forewarning which if heeded could lead to effective economic corrections.

Samuel Diminas, a petroleum geophysicist, is the Chair of the Board of Trustees of Spaces for Change, Nigeria. Email: s_diminas@yahoo.com.

No comments:

Post a Comment